The Tragedie of Macben and the Bubble Economie

Act 4

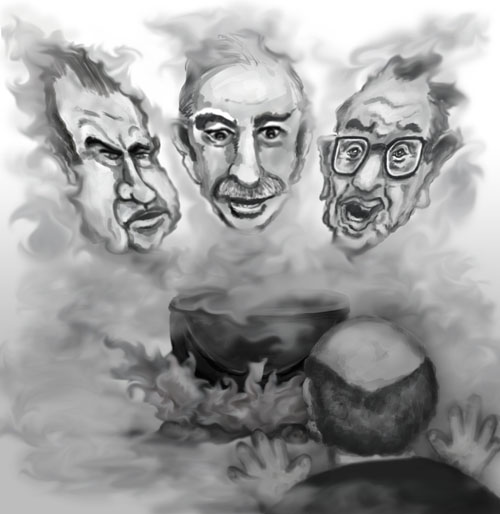

In an abandoned Metro tunnel deep below the nation’s capital, three witches are conjuring up trouble for Macben. As they parade around a steaming cauldron, the faint rumbling of an Orange Line train can be heard in the distance.

First Witch

Thrice the brittle hedge funds stumbled

Second Witch

Thrice and once the walled street tumbled

Third Witch

Speculators cry “‘Tis time, ’tis time.”

First Witch

Round about the cauldron go;

In the poison’d debt throw:

Freddie Mac and Fannie Mae

A-I-G and B-of-A

Goldman Sachs and rich folks tax

Dash of TARP and spoiled carp

Medicare and Medicaid

Student loans and underwater homes

Securitize and monetize

All

Double, double, toil and trouble;

Economy burn and cauldron bubble.

Second Witch

Pundits mumble, never humble

Irrational exuberance and unwise bets

Greek debt and subprime mortgages

Offshored jobs and moribund industries

Bloated bonuses and insider trading

Bernie Madoff and R. Allen Stanford

Into the cauldron hot and deep

All

Double, double, toil and trouble;

Economy burn and cauldron bubble.

The triple witching hour has arrived and the Weird Sisters are preparing a potion to cast powerful spells upon the economie

Third Witch

Real estate crumble, derivatives fumble

Bankers grumble and Congress bumble

Unemployment riseth and inflation loometh

Administration waverth and GSA partieth

Treasury selleth and China buyeth

Liquidity traps and shadow stats,

Mark-to-market, bondholder haircut

Moody’s, Fitch and S&P

Sovereign downgrades and party of tea

QE1, QE2 and QE3 soon to be

Manipulate and stimulate

All

Double, double, toil and trouble;

Economy burn and cauldron bubble.

Second Witch

Cool it with a failed IPO,

Then the charm is firm and good.

Enter Geitnercate with three witches

Geitnercate

Oh well done! I commend your pains,

And every one shall share i’ th’ capital gains.

And now about the cauldron sing,

Like bulls and bears in a ring,

Enchanting all that you invest in.

Second Witch

By the picking of my stocks

Something wicked this way comes.

Open, locks,

Whoever knocks.

Macben

How now, you secret, black, and midnight hags?

Has the dreaded hour of triple witching at last arrived?

What is ’t you do?

All

A deed that goes by many names.

Macben

I conjure you by that which you profess—

Howe’er you come to know it,

Insider information or salmon coloured journal

Answer me.

Though you untie the currencies and let them fight

Against the banks, though the yeasty valuations

Confound hedge fund managers and day traders alike

Though swaps be lodged and derivatives blown down,

Though investment houses topple on their warders’ heads,

Though online brokerage firms do slope

Their revenues to their foundations, though the treasure

Of the world economy tumble all together,

Even till destruction sicken, answer me

To what I ask you.

First Witch

Speak

Second Witch

Demand

Third Witch

We’ll answer

First Witch

Say, if th’ hadst rather hear it from our mouths,

Or from our masters’.

Macben

Call ’em. Let me see ’em.

First Witch

Pour in the tears of analysts that hath eaten red ink

Add lobbyist’s grease that graced the Congressional palms

Into the flame

All

Come, high or low;

Thyself and office deftly show!

A burst of light flashes down the darkened tunnel.

An apparition slowly rises from the steaming cauldron.

It is the ghost of renowned stimulator John Maynard Keynes

.

Macben

Tell me, thou long lamented sage

First Witch

He knows thy thoughts

Hear his speech, but say thou nought.

First Apparition

Macben! Macben! Macben!

Beware McRon, the thane of Paul.

Be seduced not by his gilded standard

Instead manipulate and stimulate

Dismiss me. Enough!

The specter descends back into the cauldron.

Macben

Wherever thou art, for thy good caution, thanks

Thou hast harp’d my fear aright. But one word more—

Will fair Fedres be occupied, audited or perchance abolished?

First Witch

He will not be commanded. Here’s another

More potent than the first

.

A thunderclap is heard. A second apparition slowly resolves from the cauldron’s steamy mist. It is the ghost of Richard Nixon, slayer of the gold standard and champion of fiat money.

.

.

Second Apparition

Macben! Macben! Macben!

Macben

Had I three ears and Siri too, I’d hear thee, o tormented spirit.

Second Apparition

Be greedy, bold, and resolute. Laugh to scorn

The allure of gold and its falsehearted charm

For as long as the presses roll

No harm shall visit Macben

Macben

Then preach on. What need I fear of McRon?

But yet I can’t be double sure, so I take my chance

That the fates will prescribe no nomination

And that I may continue to voice pale-hearted lies

And slumber roundly innocent of inflationary dread.

Nixon’s ghost dissolves back into the eerie fog

.

.

A lightning bolt flashes. A third apparition rises from the steaming cauldron. It is the doppelgänger of Alan Greenspan, the architect of the great housing bubble

.

Macben

What is this spirit

That rises like the issue of an elder,

Wearing upon his bald-brow creases of wisdom

While pronouncing equivocal fedspeak

Third Apparition

Be lion-mettled, proud, and take no care

Who chafes, who frets, or where investigators skulk.

Fedres shall never ruined be until

Great Bretton Woods to Foggy Bottom

Shall come against Macben.

Macben

That will never be.

Who can impress the forest, bid the tree

Unfix his earthbound root? Sweet bodements! Good!

Inflation dead, to emerge never till the woods

Of Bretton rise, and our high-placed Macben

Shall live the life of leisure, pay his breath

To time and mortal custom. Yet my heart

Throbs to know one thing. Tell me, if your art

Can tell so much: shall Bankwoe’s issue ever

Govern in this land?

The apparition condenses down into the cauldron

Macben recoils in horror when he is confronted by the ghosts of Keynes, Nixon and Greenspan and hears their dire predictions.

All

Seek to know no more.

Macben

I will be satisfied: deny me this,

And an eternal recession shall fall upon you! Let me know.

Why sinks that cauldron? and what noise is this?

To be continued…

Illustration by Kim Harris

Story by Don Rudisuhle