The Annual Greenville Holiday Crafting Workshop Ended Poorly

The annual Greenville Holiday Crafting Workshop was going quite well until Julia announced there wasn’t enough nori paste to go around. Things went steadily downhill from that point.

The annual Greenville Holiday Crafting Workshop was going quite well until Julia announced there wasn’t enough nori paste to go around. Things went steadily downhill from that point.

As the storm subsides, Mitt Romney, Paul Ryan and Seamus ride their homemade Kielbasa-Mobile into Tampa just in time to gavel open the 2012 Republican Convention

With the annoyance of Hurricane Isaac fading behind them, Republicans from far and wide are converging on Tampa, Florida to rally for their candidates and champion their proposed agenda for the country.

In order to draw attention to President Obama’s divisive policies, party strategists decided to revive the “E Pluribus Unum” motto to underscore the party’s commitment to diversity while at the same bringing all factions of the country together to strive towards a common goal of jobs and prosperity. “Out of many, one?” –Rep. Ryan immediately seized upon the expression clamoring “That’s just how sausage is made!” As an avid hunter and a member of Congress, Rep. Ryan is no stranger to the intricacies of making sausages. In his home state of Wisconsin, his prowess in making kielbasa is undisputed among fellow Cheeseheads.

Furthermore, since Rep. Ryan was once a salesman for Oscar Mayer in Minnesota, he has valuable experience with selling the sausage concept without disclosing too many details as to what went into its making, thus putting him in a strong position to articulate the Republican message on the convention floor.

In a moment of inspiration, Rep. Ryan suggested to his running mate that they rent the Weinermobile to ride into Tampa in a parade that will signal the official beginning of the Republican National Convention. Gov. Romney concurred that the imagery of a giant sausage coursing the streets of Tampa would give the campaign a boost and energize their supporters.

There was a problem, though. Among their many campaign themes was “Build America by buying American” and this gave rise to some concerns regarding potential criticism associated with riding in a vehicle built on an Isuzu chassis manufactured overseas in Japan, Gov. Romney decided against using the official Weinermobile, this in spite of his Rep. Ryan’s proficiency in its operation acquired during his college years.

So, in order to demonstrate their unshakable commitment to financial austerity and responsible spending, the duo agreed to build a custom vehicle using a vintage 1950 Plymouth Special Deluxe 4 Door Sedan that Gov. Romney found in an abandoned barn in western Massachusetts. The two did it all by themselves in their spare time, and without government help.

Seamus reluctantly agreed to accompany his owner on the jaunt in order to refute allegations of abuse and demonstrate for once and for all that he enjoys riding in a kennel on top of a vehicle. This cooperation was predicated on an understanding that he would be rewarded afterwards with one of Rep. Ryan’s tasty homemade kielbasa sausages.

The principle of lower taxes is going to be met with universal acclaim. Nevertheless, the two candidates face numerous daunting obstacles in selling their programs to the electorate, such as widespread public skepticism regarding the viability of devolving Medicaid to the states in the form of block grants that would be conveyed to insolvent spendthrift states like California, Illinois, Michigan, Nevada and New Jersey. What’s more, Rep Ryan’s bold plan for privatizing Medicare has many older Americans wondering if they are going to be on the receiving end of the sausage.

Let the good times roll!

Illustration by Kim Harris

Story by Don Rudisuhle

Act 4

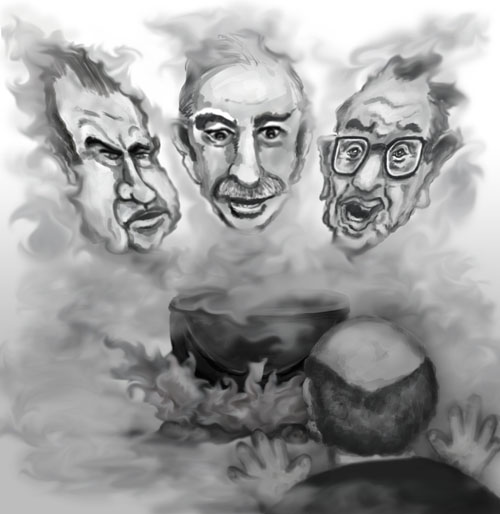

In an abandoned Metro tunnel deep below the nation’s capital, three witches are conjuring up trouble for Macben. As they parade around a steaming cauldron, the faint rumbling of an Orange Line train can be heard in the distance.

First Witch

Thrice the brittle hedge funds stumbled

Second Witch

Thrice and once the walled street tumbled

Third Witch

Speculators cry “‘Tis time, ’tis time.”

First Witch

Round about the cauldron go;

In the poison’d debt throw:

Freddie Mac and Fannie Mae

A-I-G and B-of-A

Goldman Sachs and rich folks tax

Dash of TARP and spoiled carp

Medicare and Medicaid

Student loans and underwater homes

Securitize and monetize

All

Double, double, toil and trouble;

Economy burn and cauldron bubble.

Second Witch

Pundits mumble, never humble

Irrational exuberance and unwise bets

Greek debt and subprime mortgages

Offshored jobs and moribund industries

Bloated bonuses and insider trading

Bernie Madoff and R. Allen Stanford

Into the cauldron hot and deep

All

Double, double, toil and trouble;

Economy burn and cauldron bubble.

The triple witching hour has arrived and the Weird Sisters are preparing a potion to cast powerful spells upon the economie

Third Witch

Real estate crumble, derivatives fumble

Bankers grumble and Congress bumble

Unemployment riseth and inflation loometh

Administration waverth and GSA partieth

Treasury selleth and China buyeth

Liquidity traps and shadow stats,

Mark-to-market, bondholder haircut

Moody’s, Fitch and S&P

Sovereign downgrades and party of tea

QE1, QE2 and QE3 soon to be

Manipulate and stimulate

All

Double, double, toil and trouble;

Economy burn and cauldron bubble.

Second Witch

Cool it with a failed IPO,

Then the charm is firm and good.

Enter Geitnercate with three witches

Geitnercate

Oh well done! I commend your pains,

And every one shall share i’ th’ capital gains.

And now about the cauldron sing,

Like bulls and bears in a ring,

Enchanting all that you invest in.

Second Witch

By the picking of my stocks

Something wicked this way comes.

Open, locks,

Whoever knocks.

Macben

How now, you secret, black, and midnight hags?

Has the dreaded hour of triple witching at last arrived?

What is ’t you do?

All

A deed that goes by many names.

Macben

I conjure you by that which you profess—

Howe’er you come to know it,

Insider information or salmon coloured journal

Answer me.

Though you untie the currencies and let them fight

Against the banks, though the yeasty valuations

Confound hedge fund managers and day traders alike

Though swaps be lodged and derivatives blown down,

Though investment houses topple on their warders’ heads,

Though online brokerage firms do slope

Their revenues to their foundations, though the treasure

Of the world economy tumble all together,

Even till destruction sicken, answer me

To what I ask you.

First Witch

Speak

Second Witch

Demand

Third Witch

We’ll answer

First Witch

Say, if th’ hadst rather hear it from our mouths,

Or from our masters’.

Macben

Call ’em. Let me see ’em.

First Witch

Pour in the tears of analysts that hath eaten red ink

Add lobbyist’s grease that graced the Congressional palms

Into the flame

All

Come, high or low;

Thyself and office deftly show!

A burst of light flashes down the darkened tunnel.

An apparition slowly rises from the steaming cauldron.

It is the ghost of renowned stimulator John Maynard Keynes

.

Macben

Tell me, thou long lamented sage

First Witch

He knows thy thoughts

Hear his speech, but say thou nought.

First Apparition

Macben! Macben! Macben!

Beware McRon, the thane of Paul.

Be seduced not by his gilded standard

Instead manipulate and stimulate

Dismiss me. Enough!

The specter descends back into the cauldron.

Macben

Wherever thou art, for thy good caution, thanks

Thou hast harp’d my fear aright. But one word more—

Will fair Fedres be occupied, audited or perchance abolished?

First Witch

He will not be commanded. Here’s another

More potent than the first

.

A thunderclap is heard. A second apparition slowly resolves from the cauldron’s steamy mist. It is the ghost of Richard Nixon, slayer of the gold standard and champion of fiat money.

.

.

Second Apparition

Macben! Macben! Macben!

Macben

Had I three ears and Siri too, I’d hear thee, o tormented spirit.

Second Apparition

Be greedy, bold, and resolute. Laugh to scorn

The allure of gold and its falsehearted charm

For as long as the presses roll

No harm shall visit Macben

Macben

Then preach on. What need I fear of McRon?

But yet I can’t be double sure, so I take my chance

That the fates will prescribe no nomination

And that I may continue to voice pale-hearted lies

And slumber roundly innocent of inflationary dread.

Nixon’s ghost dissolves back into the eerie fog

.

.

A lightning bolt flashes. A third apparition rises from the steaming cauldron. It is the doppelgänger of Alan Greenspan, the architect of the great housing bubble

.

Macben

What is this spirit

That rises like the issue of an elder,

Wearing upon his bald-brow creases of wisdom

While pronouncing equivocal fedspeak

Third Apparition

Be lion-mettled, proud, and take no care

Who chafes, who frets, or where investigators skulk.

Fedres shall never ruined be until

Great Bretton Woods to Foggy Bottom

Shall come against Macben.

Macben

That will never be.

Who can impress the forest, bid the tree

Unfix his earthbound root? Sweet bodements! Good!

Inflation dead, to emerge never till the woods

Of Bretton rise, and our high-placed Macben

Shall live the life of leisure, pay his breath

To time and mortal custom. Yet my heart

Throbs to know one thing. Tell me, if your art

Can tell so much: shall Bankwoe’s issue ever

Govern in this land?

The apparition condenses down into the cauldron

Macben recoils in horror when he is confronted by the ghosts of Keynes, Nixon and Greenspan and hears their dire predictions.

All

Seek to know no more.

Macben

I will be satisfied: deny me this,

And an eternal recession shall fall upon you! Let me know.

Why sinks that cauldron? and what noise is this?

To be continued…

Illustration by Kim Harris

Story by Don Rudisuhle

The dragon on the Chinese plate stealthily reaches for the Tibetan Cat with his razor-sharp sharp claws

The Chinese Plate and the Tibetan Cat have yet to settle their differences.

Illustration by Kim Harris

Jeffrey Neely, Angry Clown and Gumby enjoy refreshing beverages while relaxing in the hot tub after a hard day of reviewing resorts and sampling gastronomical delicacies.

After a hard day of scouting out resorts and sampling the offerings of Las Vegas’ finest caterers, General Services Administration Western Region Director Jeffrey Neely decided that a bubble bath in his suite at the M Resort in Las Vegas would be in order.

Upon viewing the images in the news media, many have asked the question: Who was the second glass of wine for? Well, not to be selfish, Director Neely decided to share the experience with two colleagues that he had recently identified as prospective performers for the festivities planned in connection with the GSA’s 2010 Western Regions Conference. Mr. Pagliaccio was selected to perform as his character, the cigarette-puffing Angry Clown who continuously creates disharmony in an office environment. Gumby was brought in to reinforce the GSA’s commitment to their “Going Green” campaign. Gumby was also expected to be a guest artist during the Green Man Group’s performance at the conference.

Earlier in the day, the three had sampled the Petite Beef Wellington and Mini Monte Cristo sandwiches that were proposed to be served to the civil servants attending the networking reception. Mr. Neely and Mr. Pagliaccio both ordered a glass of vintage Napa Valley Cabernet from room service. Gumby, who comes from a less privileged background and who arguably has a somewhat unrefined palate, settled for a bottle of Mike’s Hard Lemonade.

The soothing bath and the relaxing drinks prepared the trio for the next challenging event of their rigorous resort scouting trip. They were tasked with awesome responsibility of evaluating the proposed fare that consisted of Boursin Scalloped Potatoes and Barolo Wine Braised Short Ribs that would be featured at the conference’s closing dinner.

There have been recent stories in the media that reveal that Mr. Neely and his wife have enjoyed holidays in Hawaii and other Pacific islands while ostensibly on important official US Government business. Wow! To be able to live as largely as a Federal civil servant!

Illustration by Kim Harris

Story by Don Rudisuhle

Anyone who follows politics knows about Nancy Pelosi, the former Speaker of the House and a leading proponent of the Health Care Reform Bill that was rushed through Congress in 2009 using the controversial reconciliation process. Many are also aware that she has been involved in the wine business in California for many years as the owner of Zinfandel Lane Vineyard, a producer of premium grapes in St. Helena and also as a major investor in the bulk wine producer, Ernest & Julio Gallo.

One evening we caught a glimpse of Rep. Pelosi enjoying a glass amongst the grapevines in her vineyard. We could not help but wonder, is it a glass of Liparita’s prize-winning Cabernet Sauvignon or is it perhaps a snort of Night Train or Thunderbird, two revolting Ernest & Julio Gallo inebriants typically associated with the bottom rungs of the lowest quartile of the Ninety-Nine Percenters?

Nancy just said “You have to drink it to know what’s in it.”

Illustration by Kim Harris

Story by Don Rudisuhle

Two sales representatives from the badger clan await the arrival of their underworld contacts to consummate yet another profitable bone transaction

An article published recently by the BBC in the UK brought to light a shocking discovery at the Radnor Street Cemetery in Swindon, a town about 80 miles west of London in the County of Wiltshire. The soil has been disturbed, grass has been torn up, headstones have been toppled and exposed bones have been found at the site. At first it was thought that this was the work of vandals. However it was soon revealed that badgers have been digging up graves in this cemetery that dates back about 130 years where some 33,000 people have been laid to rest since Victorian times. Now, little by little the old bones are being brought to the surface by a group of enterprising badgers that have built a network of tunnels under the graveyard.

The crafty animals are fond of using existing structures such as roads or foundations of buildings as roofs for their setts, which are networks of underground tunnels that comprise a badger’s den. Therefore it should not come as a surprise that the bottom surface of a casket would serve as an ideal roof for a sett. It follows logically that the industrious badgers would soon discover the contents of the caskets. It is not known what would possess the creatures to remove the bones from their resting place and deposit them on the surface. Maybe they’re simply clearing out the casket to create additional living space for their clan.

At first it appeared that there would be a simple solution to the problem. The badgers could be trapped and removed and taken somewhere else. The parish council proposed that the badgers be relocated to a nearby site where they would be less likely to engage in destructive mischief. However, the conservation group Natural England intervened and blocked this proposal on the grounds that this would constitute a violation of the Protection of Badgers Act of 1992, which prohibits the taking or otherwise injuring of badgers or disturbing a sett. Natural England is an NGO whose conservation mandate is set forth in legislation as the government body responsible for the stewardship of the country’s natural environment. Not long afterwards, another NGO, English Heritage, which is funded by the UK Department for Culture, Media and Sport, also stepped in and took a position against the idea because it is believed that the field selected for the relocation might have at one time been the site of a medieval house. In addition, the entire matter is further complicated by the fact that the cemetery was declared to be a Local Nature Reserve back in 2005.

This is not the first time that this phenomenon has occurred. In 2010, children began to bring home bones they found in a field adjacent to 12th century St. Remigius church in the village of Long Clawson in Leicestershire, a small town about 130 miles north of London that is famous for its award-winning Blue Stilton cheese. Other residents reported seeing a skull and other bones protruding from the earth.

This, too, proved to be the work of badgers. The village vicar, Rev. Simon Shoule performs regular excursions into the graveyard to search for bones which he gathers up and buries in a new grave, which cannot be anywhere near the original site due to government regulations that prohibit disturbing the badgers in any way. This has irritated the families of the deceased to see their loved ones’ remains scattered asunder and buried anonymously at other locations.

But that is not the end of the story.

Little did the villagers know the badgers’ real motivation in digging up the grave sites. It wasn’t to make more room in their burrows. They already had more tunnels and chambers than they needed to accommodate their extended families. The real reason was far more sinister. Some years back, the badgers had made contact with an underground criminal ring that was engaged in the trafficking of illegally obtained human body parts. This ghoulish gang colluded with morticians at funeral homes who would remove bones and other tissues from corpses and surreptitiously replace them with lengths of PVC pipe, leaving the bereaved none the wiser. These bones were subsequently sold to body brokers or biomedical tissue companies who in turn resold them for use as dental implants and other procedures involving unsuspecting patients.

When law enforcement turned up the heat on their illicit business, the gang sought out other sources of bones that were less likely to attract the attention of the authorities. With an average sale valued at over $7,000, it did not take the badgers long to discover what a lucrative business this was. In their pursuit of quick riches, the badgers were not really concerned about the consequences of their actions. They engaged in many financial excesses and bought expensive watches and fashionable suits of clothes to wear when they came to the surface to conduct their nefarious business transactions with the shady bone merchants.

The badgers did not even stop to think seriously about the possibility that the old bones might still contain dangerous bacteria and viruses. It is a well-known fact that many of the individuals interred in the cemetery were victims of anthrax, cholera, tuberculosis and other communicable diseases. These organisms have been shown to survive in the soil for very long periods of time, even centuries.

The badgers didn’t really care about the human public health consequences. After all, they were plenty angry that the UK Department of Agriculture and Rural Development had fingered them as the source of the alarming spread of bovine tuberculosis in the countryside, which resulted in the slaughter of approximately 25,000 cattle in 2010 for the purpose of controlling the epidemic. This pronouncement led to the infamous Big Society Badger Cull, a government sanctioned extermination effort that was responsible for the deaths of untold thousands of innocent badgers. Ironically, subsequent studies by independent scientists demonstrated that this carnage had not made a meaningful contribution to the reducing the spread of bovine TB in cattle.

So, what goes around comes around…

Illustration by Kim Harris

Story by Don Rudisuhle